This is me encouraging people to jump onto the personal finance rabbit hole on Instagram. And not just to follow the content, but to actually create a separate account just for your financial journey.

Let me break down the reasons.

Table of Content

#1 Build Accountability & Stronger Habits

Many people who started the personal finance alter egos post goals and progress as a way to stay accountable. Afterall consistency builds habits.

Sometime being in the 'space' that isn't of your circle of competence can over time demystifies complex topics and build the confidence you need.

Even now, when I'm onto something new and it feels scary, I don't act on them immediately. I let myself immerse in it. Okay, partly the inaction is because I don't have the funds to act on them woops. But it's on the back of my mind when I wake up, work, exercise, showering, eat, sleep whatever. Ohmmm. When I'm ready, I know I will act mindfully and less on impulsive feelings.

#2 Protect Your Privacy and Peace

Most importantly, this alter ego acts as a safe space.

You can share financial wins, struggles, and goals without fear of judgment—something you might not do with family or friends.

Money talks should not be a taboo subject but can raise negative emotions to some people who may be in a different stage in their financial journey or who may not yet have the financial knowledge or the emotional bandwidth to engage with it comfortably.

To put it simply, there are people who will be jealous. We cannot control that but we can create a boundary through privacy.

At the initial stage of this account creation, I was open to connecting with like-minded individuals. Tho over time, I learnt that only those who works towards progress or already in a better place _ and still learning _ are the least judgmental or envious ones.

The ones who are stuck _ who choose to remain in their uncomfortable comfort zone and justify it _ who are the ones unhappy with your progress. And then I'll hear a piece of their "intelligent" opinions about being poor supposedly means being humble or how suddenly I may have appeared to have less compassion because being rich (for me it's achieving my goals, I'm not rich yet) is unfairly associated with evil. Mind blowing.

That's why now I rather be talking to successful people online. They have been such a great sport in motivating me in my personal finance journey, serving as role models and benchmarks for me.

#3 Your Net Worth Is in Your Network

Yes, you're the average of the five (but let's not limit to 5) people you spend most time with yada yada. I think in many ways, this phrase speaks for itself.

Tho I'm just going to add this: you don't necessarily need to ditch your current circles, but you can simply expand your circle and still average up.

Who knows your new connections could be the cheerleader or mentor you need. Or they might simply expand your perspective and show you money goals you never even knew were possible.

#4 Embrace Lifelong Learning

Whether it's learning new money subjects or keeping up-to-date with the news and financial offerings. Subjects like:

- How to get more tax deductions when filling your Annual Income Tax? This year I learnt that self-contributing in EPF can do that

- Have you heard of KWSP i-Saraan which benefits self-employed individuals?

- What about eGumis Unclaimed Money?

- How much did Bank Rakyat declared for 2025 dividend?!

- What brokerage account to start investing? For me it's MooMoo because you can set up the account almost immediately and can invest in Malaysia, Singapore, US and Hong Kong! If you want, this is my MooMoo Referral Link or Invitation Code ECMV2BJM 🫶🏼

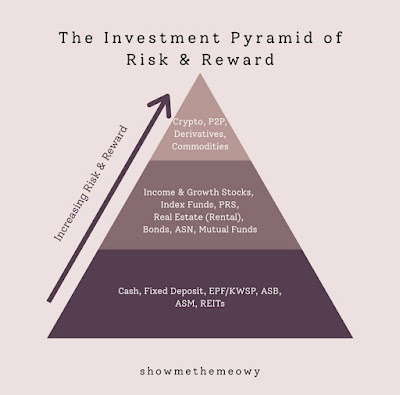

- What are the different investing vehicles available in Malaysia? I made this Investment Pyramid of Risk & Reward back in 2020 and I still think it's relevant today.

Follow enough personal finance accounts and you'd notice the different investment styles

- How risk averse are they and then how do they cater their strategies to suit their styles?

- What's their respective Magic Money Formulas? Do they make their money by property, business, stocks or what is it?

- What worked and what didn't? You don't need to experiment on every single types of investments, just learn from what others have tried.

- Who can you relate to? Follow them! Cannot relate? Still follow them and figure out why they said the ABCs and XYZs.

- Hard work or good luck? Psst, I wrote a post about this topic!

#5 Make Space for Mental Breaks

The other thing with a separate account is this point really.

When you're in the starting point of this whole FIRE Movement, or learning anything new really, a lot of things can seem overwhelming and intimidating.

Sometimes you just get sick or annoyed or unmotivated or just needing a break from all these financially woke, super motivated, people who seem to be in a different stage of financial freedom. At least I did.

Other days I'd rather immerse in less brainy subjects and just scroll through unserious contents.

And so I take a step away, unwind before stepping back in _ the former is important!

Conclusion

I hope I've brainwashed you into making a move to join the personal finance or FIRE (Financial Independence Retire Early) community in Malaysia.

May you find people who genuinely want to grow, share, and support one another—without the judgment or noise that usually comes with money talk.

May you also grow rich! Cheers!

Comments

Post a Comment